The Trouble with Target

I grew up in Target stores. Almost literally. My dad, Ken Macke was a Target executive all through the 1970s and early 80's. He later became CEO of Target's parent company (Dayton Hudson) but deep in his heart my dad was a Target guy his whole career and, really his whole life. As a proto-Baby Boomer workaholic my dad put no stock at all in the idea of Work-Life balance. Work was life. Dad was asked what his hobbies were and he said "Going to stores". He wasn't kidding.

Pretty much every weekend would involve one or two trips to Target with dad. It gave me a feel for the place. I can tell how a store is doing right when I walk through the doors. We have a (mediocre) Target near our house and I find myself going once or twice a week, whether I need to or not. I look at things like how the endcaps are stocked and how complete the size ranges are. I want to see shelves that are full, but not stuffed, with everything I would expect (underwear) and maybe something I didn't know I needed ("what a nice, affordable belt").

With this level of emotional investment I want to be long Target. I feel like the world is a better place when Target is clicking and for the last few years Target hasn't been clicking at all.

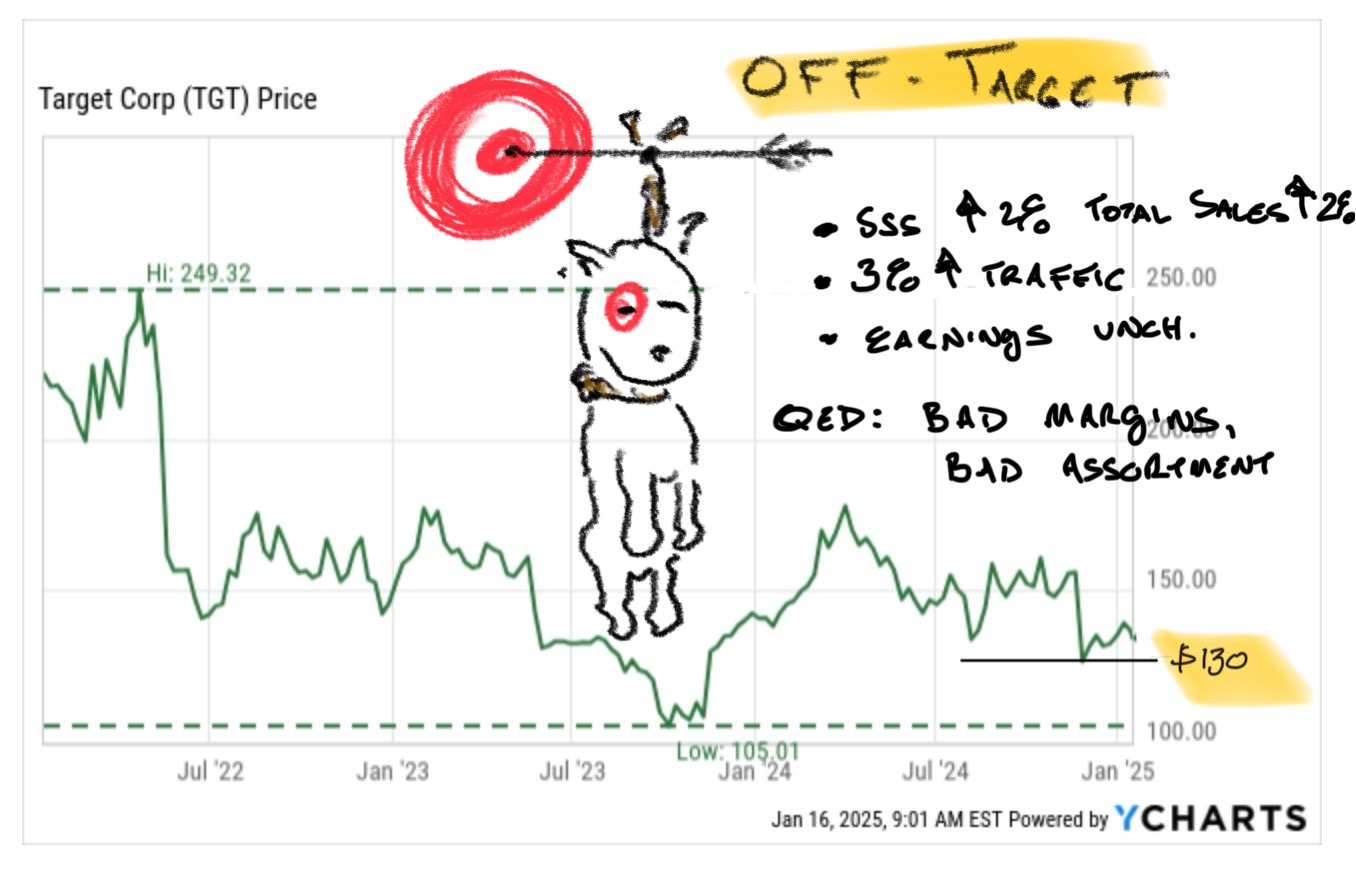

Target pre-announced its holiday results this morning to the sound of sad trombones. Same store sales were up but barely and earnings are seen as unchanged from the prior guide. The company noted strength in apparel, which are high-margin product. The e-commerce side was up 9% driven by same-day-delivery but is still less than 15% of sales. So either margins in apparel are worse than expected or e-commerce is eating up a ton of money and still not growing very fast. For bulls the hope had been that Target pulled a ton of expenses forward when it mishandled inventory in Q3 (Target rushed a bunch of product early for a dock strike that never really happened).

It didn't happen. Target has now spent nearly 3 years trying to stop losing back the share it gained during the COVID lockdown. The stock seems cheap but there's no catalyst in sight. Online isn't profitable, the stores are under-stocked and the product they have is locked up. Traffic is up 3% but Comps barely budge, customers aren't finding what they want.

CEO Brian Cornell is leaving at the end of the year. It's too late for him to turn Target around and it's too early to invest in a company frantically running to stand still. It's Walmart, Costco and Amazon's world; maybe Target doesn't have a place in it.