Walmart Isn't Sorry

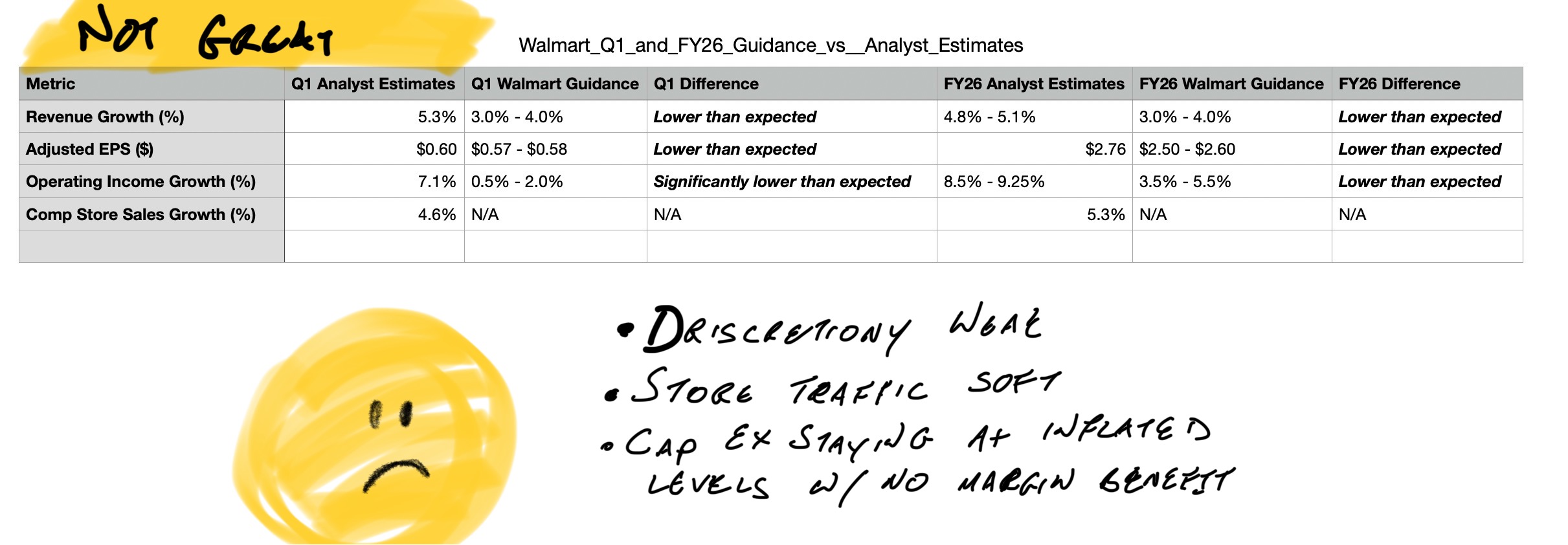

Walmart is getting smacked around by as much as 10% ahead of the conference call (as I type) after the World's Biggest Retailer reported somewhat uninspired Q4 Results and guided below most estimates for next year. Plenty of reasons for the initial drop will be given and they'll all have at least grains of truth. Traffic was bad, discretionary was soft. The huge spending Walmart has been doing for the last 3 years (up over $10b/yr since 2021) is going to stay at about 3.-3.5% revenue.

Now, as mentioned about Amazon, it's not really a bad thing for Walmart to be spending. But if the company wants to save the stock from going below the 200-day during the call, management better be able to connect the dots on how what is going to be ~$100b of CapEx over 5 years will lead to a gain in profits. Or revenues. Pretty much anything tangible will likely assuage some of these early nerves.

Are things really this bad? They don't seem to be. Let's see if Walmart can justify my faith...

The Call Begins:

- CEO Doug McMilon is bringing a chill energy to the call. Mentions e-commerce is now over $100b.

- Advertising came in at the expected ~$3b. Nice growth, but not accelerating.

- "Last year we started to referring to ourselves as 'a people led, tech-powered, omni-channel retailer dedicated to helping people save money and live better'." Ummmm... As long as you're staying focused.

- Walmart saves 75% of households in Dallas / Fort Worth will have access to drone delivery by year-end. This sounds both insane but also a way Walmart and Amazon are distancing themselves from the pack on delivery. Walmart gives you three ways to get same-day (drive-up, store delivery, have it dropped on your house by a military-grade drone). On its last call Target was excited about 5-day delivery for straight on-line orders. Why bother?

- Speaking of "why bother," electronics are also weak at WMT (and Target and Costco). People will be amazed at how much share Best Buy takes when demand comes back for TVs.

- CFO comes on to dig into the financials, which all seem decent. This isn't a down 10% quarter.

- "We increasingly use stores to fulfill online orders, " driving e-commerce profits higher. Fact: 80% of the country can get from their front yard to a Walmart parking lot in under 50 golf strokes. Not really but they have ~5,000 stores in the US so I bet that figure is closer than you'd think.

- Marketplace grew 20%. That number needs to, and should, pick up some more before it levels off. Amazon still beyond dominates the space.

- "We generated over $35 billion in operating cashflow this year, an increase of nearly 24%". I mean... it's not Goolge-cash but that's a lot for a retailer. Walmart can afford to invest in a whole fleet of drones with $35b coming in the door.

Margin Drivers:

Business Mix: New initiatives have significantly higher margins than the traditional retail business. Attaboy! (doing that "testify" thing my hands over my head.

Productivity Improvements: Walmart is automating DCs and stores at a furious pace. "55% of fulfillment center volume and 65% of supercenters serviced by automated refill by the end of F26". The Bots are Here! Expecting to see a pronounced benefit from... um.... shhhhh... wage improvements through automation by the end of this year.

Product Mix: Walmart is using food as a way to bring in the traffic for general merchandise. This isn't great news for Target if we're being honest. "We're encouraged by the share gains we are seeing".

Geographic Mix: International will hit $200b by FY27, which is double digit growth.

I love a specific list of profit drivers and KPIs. Tell us what you're going to do and do it. Walmart is telling us how they are going to drive large but still unquantifiable gains coming in the next 6 quarters. It makes Walmart an expensive stock but a brutal short.

Guide:

Expecting operating income to grow faster than sales, which Walmart foresees continuing. Stocks can get cheap two ways; by crashing or making more money. Walmart is doing its part on the second half of that (but not for a couple more quarters).

Takeaways:

- This quarter scares me more for Target than it does Walmart. Walmart has a plan and $35b/yr to put that plan into place. Target is lacking both of those things.

- I wrote about Walmart's stock ramping with CapEx. At this point, investors are either buying into management's vision or should have sold years ago.

- If I wasn't long Walmart already I'd likely be buying this dip. As is I'm Ok with the sell-off. Walmart is coming off its 7th best year for the stock in its 55 years of public history. A) Those returns have tended to cluster, rather than reverse. Meaning I'm not overly worried about regression. B) A pause is just fine here.

- Mediocre though it was this quarter and guidance raises the bar for Target and other retailers as the group starts reporting in earnest next week. If Walmart is taking share with numbers this soft it implies a tough market for the non-$700 billion retailers (N= "everyone else")

- It's important to keep in mind just how terrible a retail business is on the bottom line. Walmart is grinding out 6.6% EBITDA margins. But that meager amount is why any margin gains make this a much cheaper stock, very fast. Walmart is cranking out more cash than Target (~$8.2b) and Costco ($14b) combined. At $700b/ yr in revenue any margin improvement widens the gap appreciably.

Final Grade: B+