Retailers Taking a Pause to Refresh

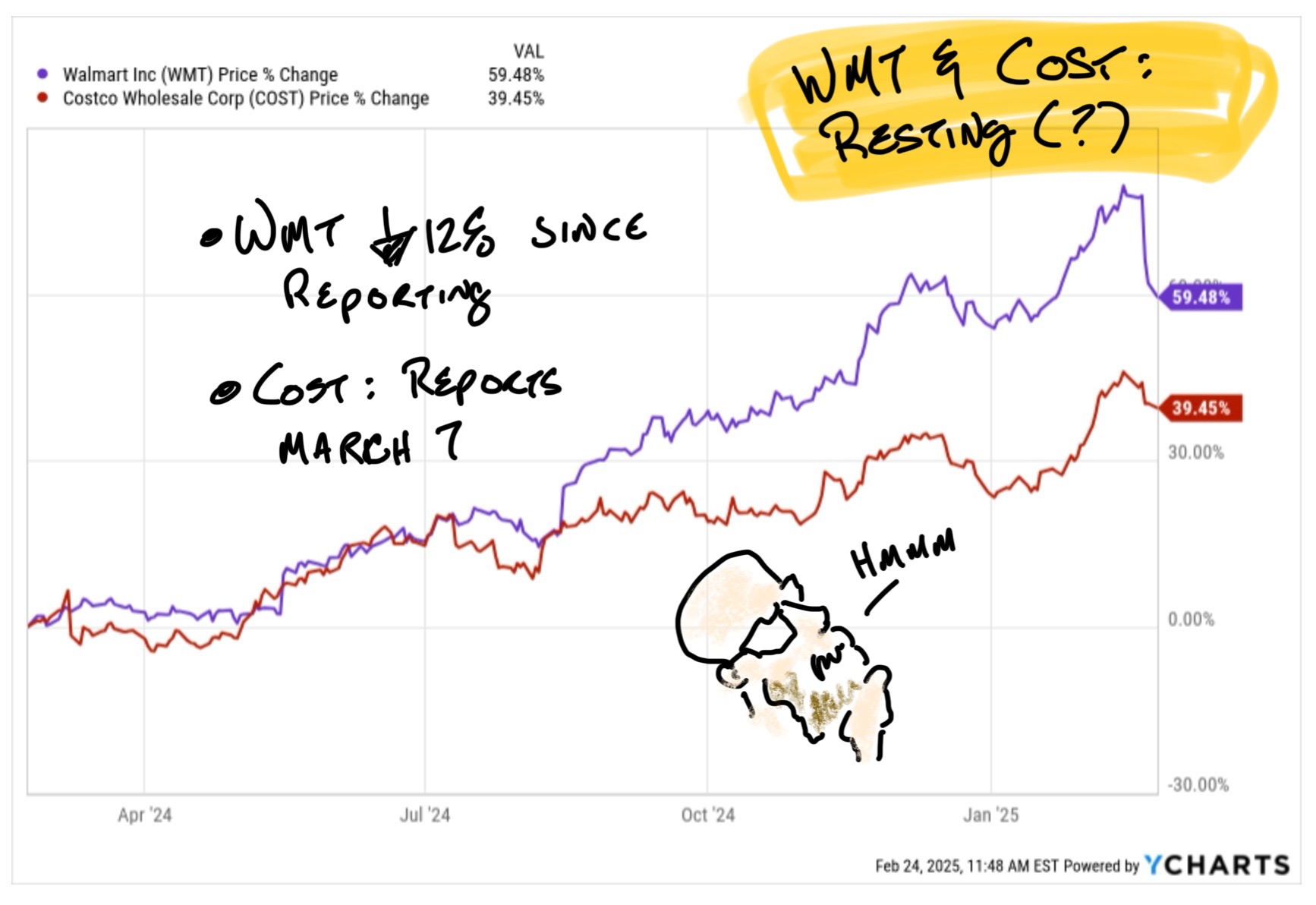

Walmart still isn't sorry but the stock didn't bounce either. The company's story didn't change ("we're investing for growth, the consumer is 'meh', the profits will come") but the amount Wall St is willing to pay for such narratives rather than more traditional financial measures like "profits" down-ticked last week across the board for anything related to consumer spending.

Every earnings period tells a little story. As the company's report a theme takes hold and suddenly every earnings call becomes a debate over less the specific news being reported than the context in which the report took place. Walmart said revenue was going to be a little slow and profits would be back end-loaded. Now, that's the kind of thing Walmart always says. If you think about, there's no reason Walmart would do anything other than set the bar low ahead of the least-important quarter of the year.

All of which is fine but it hasn't saved the stock just yet. Costco and Walmart led retailers higher and they're more than due for a pause. With both stocks >35x earnings and Costco not set to report for another 2 weeks investors are willing to wait.

The Wake of Walmart

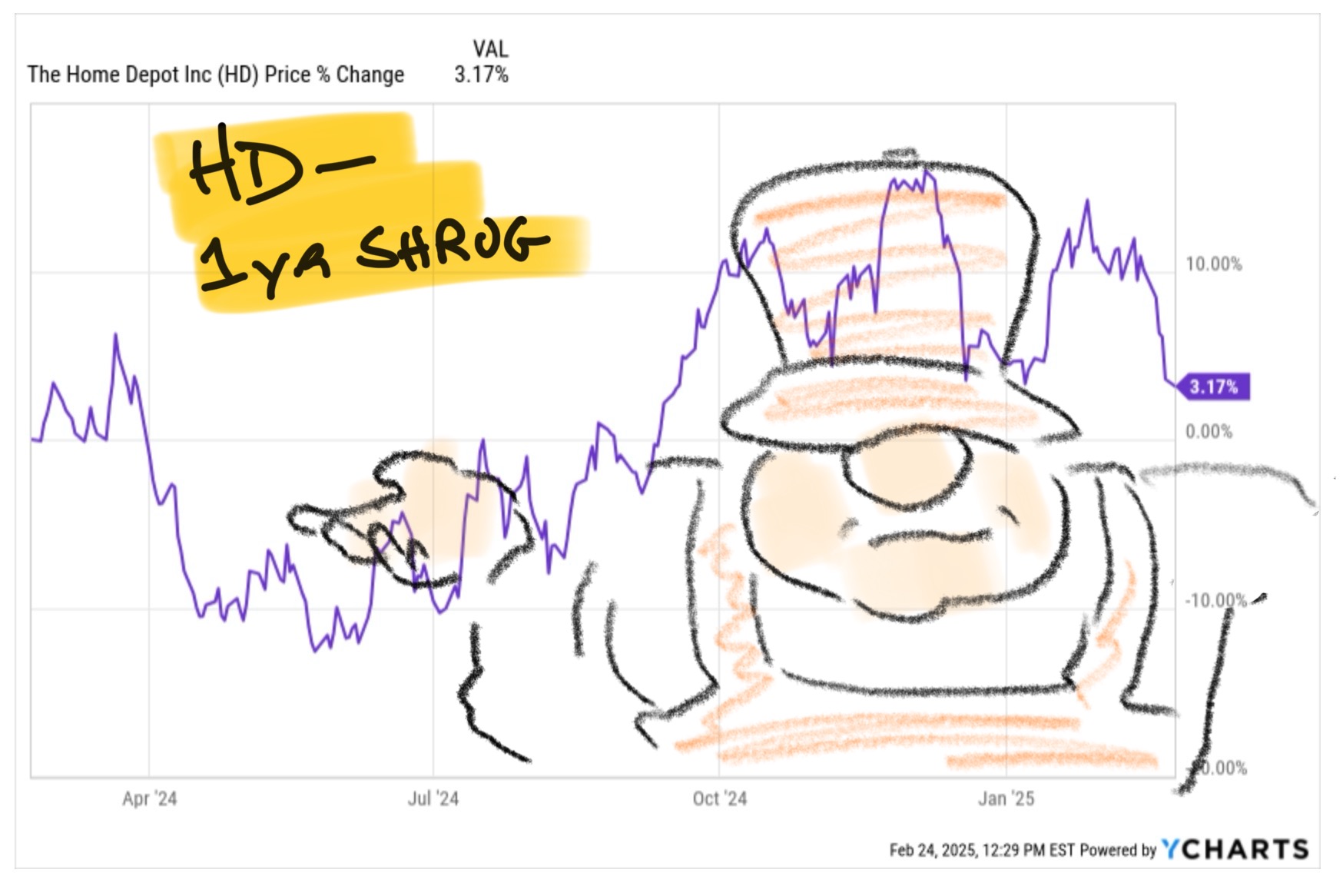

Walmart casts a shadow, as companies of that size do. But it's specific to the discount/ grocery / economic mid-tier and other juggernauts. When Home Depot reports tomorrow directly or indirectly the results will be seen through the lens of Walmart's guidance for essentially flat comps. Lowe's, TJX, Advanced Autoparts, Best Buy and Costco have all had the bar lowered just a little bit by Walmart failing to impress.

I'm not expecting great things out of HD in the morning. The stock has been in a 1 year funk and nothing they say in the morning is going to convince people otherwise. As a dominant player in a non-sexy space HD has been more than holding its own but "Uptick in Remodels" isn't on anyone's bingo card for the next few months and HD is unlikely to change that.

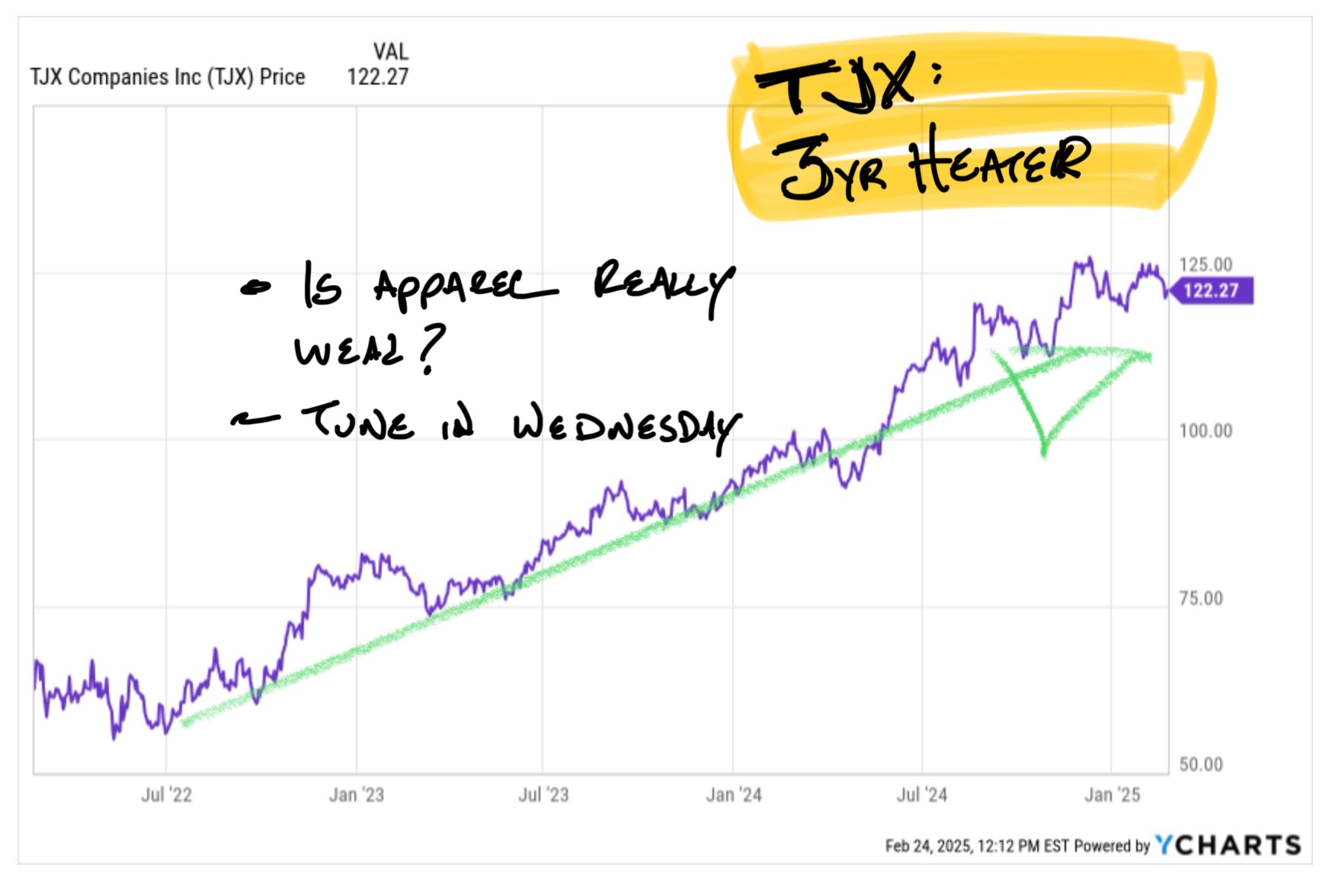

This week for apparel, watch TJX on Wednesday morning. These guys are among the best operators in the business of off-price apparel. It's the kind of company that outperforms in slightly down economies, which is what the markets are suddenly hedging against post-Walmart.

If TJX has problems it'll be another dead canary outside the discretionary coal-mine.

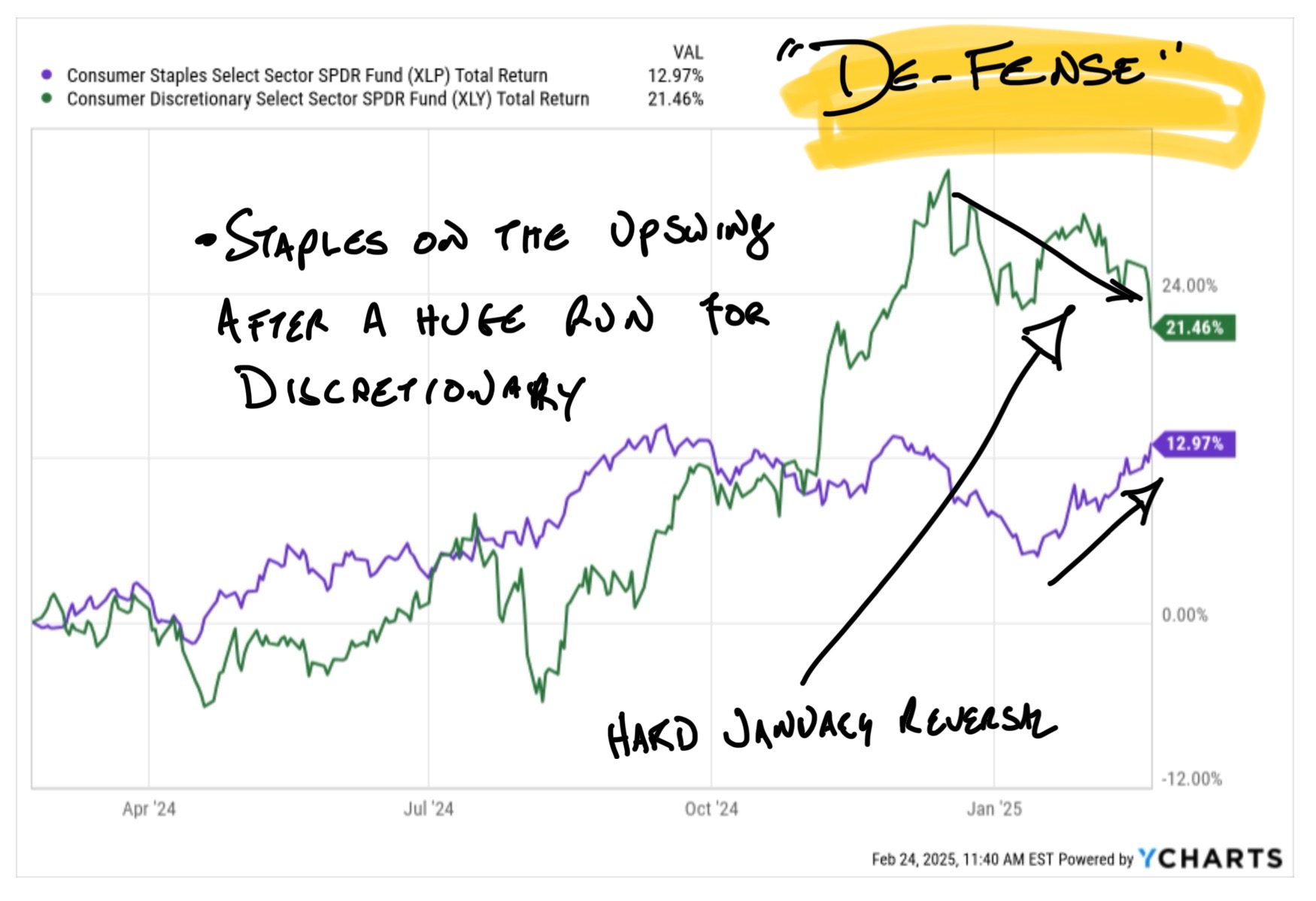

The next few days will be spent compiling datapoints and placing bets for the big Retail Earnings Dump starting next week. The shift out of momentum and into Staples and formerly unloved names like Nike (?!) and Starbucks (Yay) is in full swing. Sign up for daily emails and follow the news here!