The Consumer Suffers a Spring Break

Welcome to the least efficient Monday of the year! The Monday after clocks "Spring Forward" sees a 6% increase in auto fatalities across the US. There is also a 24 percent increase in heart attack incidence and an 8 percent spike in strokes, with the elderly at particular risk.

Adjust your risk appetite and stress levels accordingly as we dive into another week of retail earnings. Retail is generally front-loaded by quality when it comes to reporting. Walmart kicked it off a couple of weeks back. Last week we heard from higher-end mall operations like ANF and GAP (more on them in a moment). This week we're going to the somewhat darker corners of the mall store world and some of the moldier big box operations.

Things aren't going to get less perilous.

On the one hand we know absolutely everything we need to know in regards to general consumer trends and categories. Christmas was fine but ancient history. Here are the themes that matter:

- Beat and Guide Lower due to (pick one or more): Tariffs, recession fears, general uncertainty.

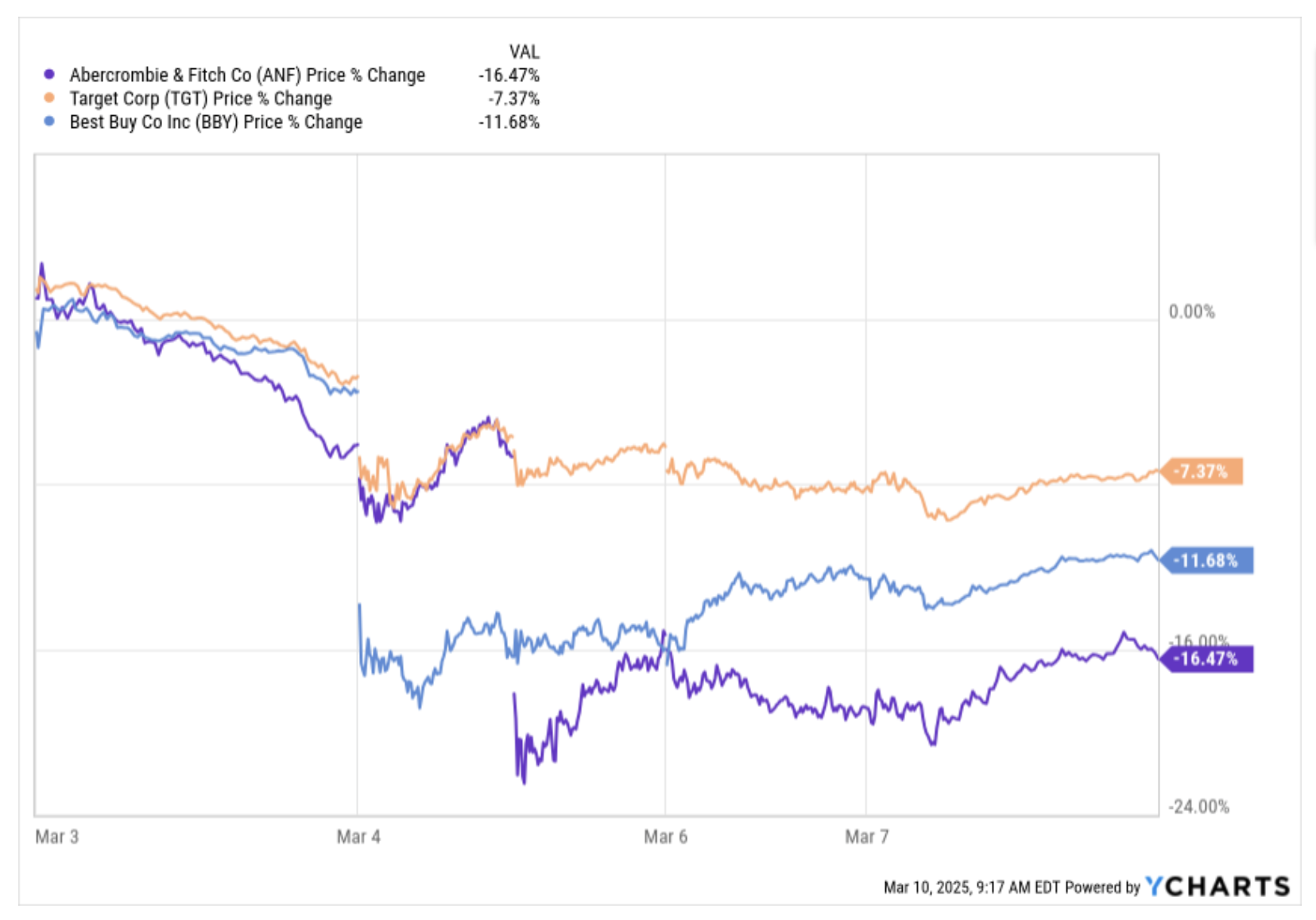

Walmart, Target, Foot Locker, Victoria's Secret, Bath and Body Works, Best Buy, Lowes.... just, pretty much everyone is telling us the consumer has at least dipped for all but the hottest chains. Where expectations were low going in the damage was generally limited. Anyone reporting company-specific weakness got taken to the woodshed:

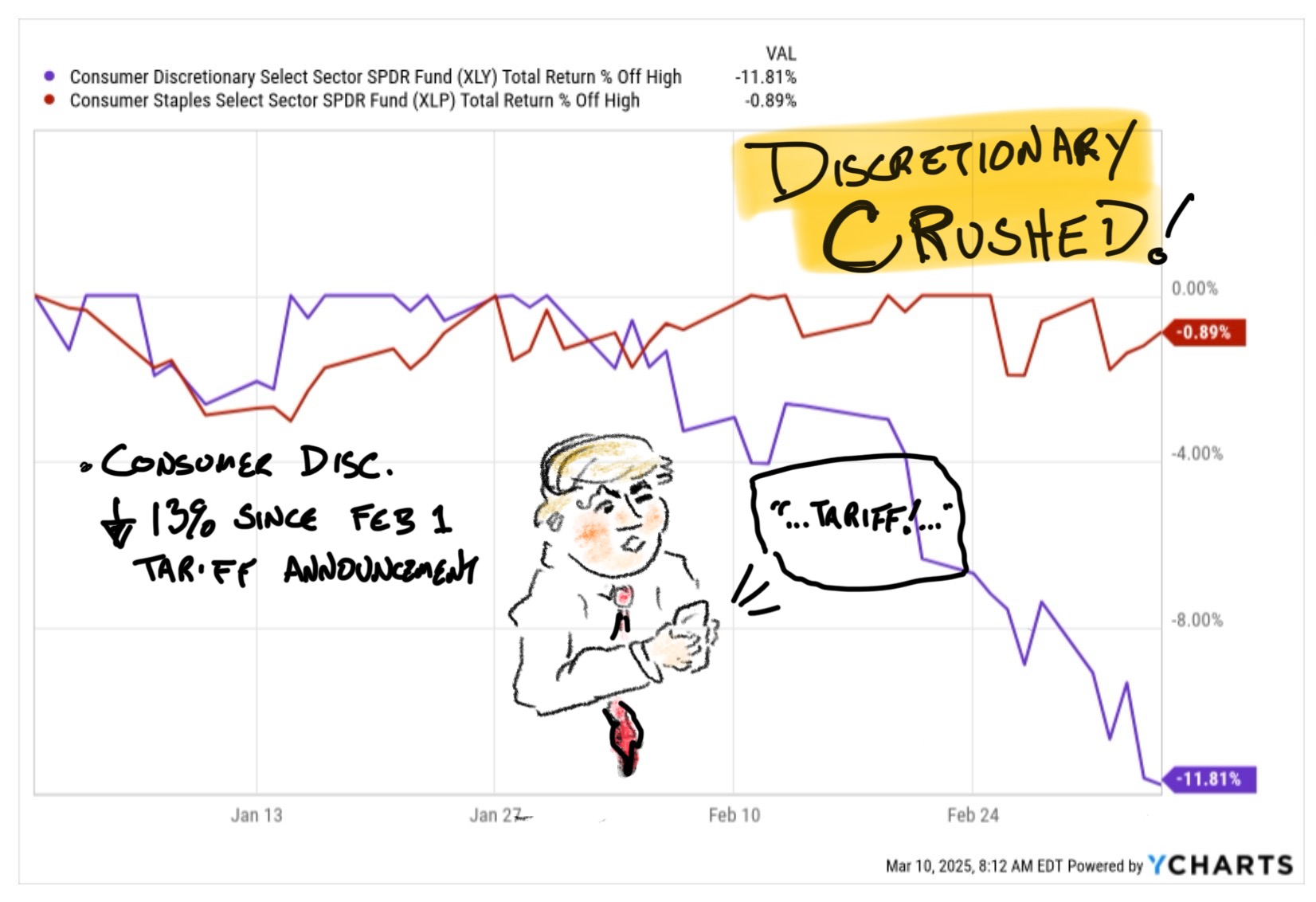

- Tariffs are a Large But Unquantifable Negative, especially for Consumer Discretionary

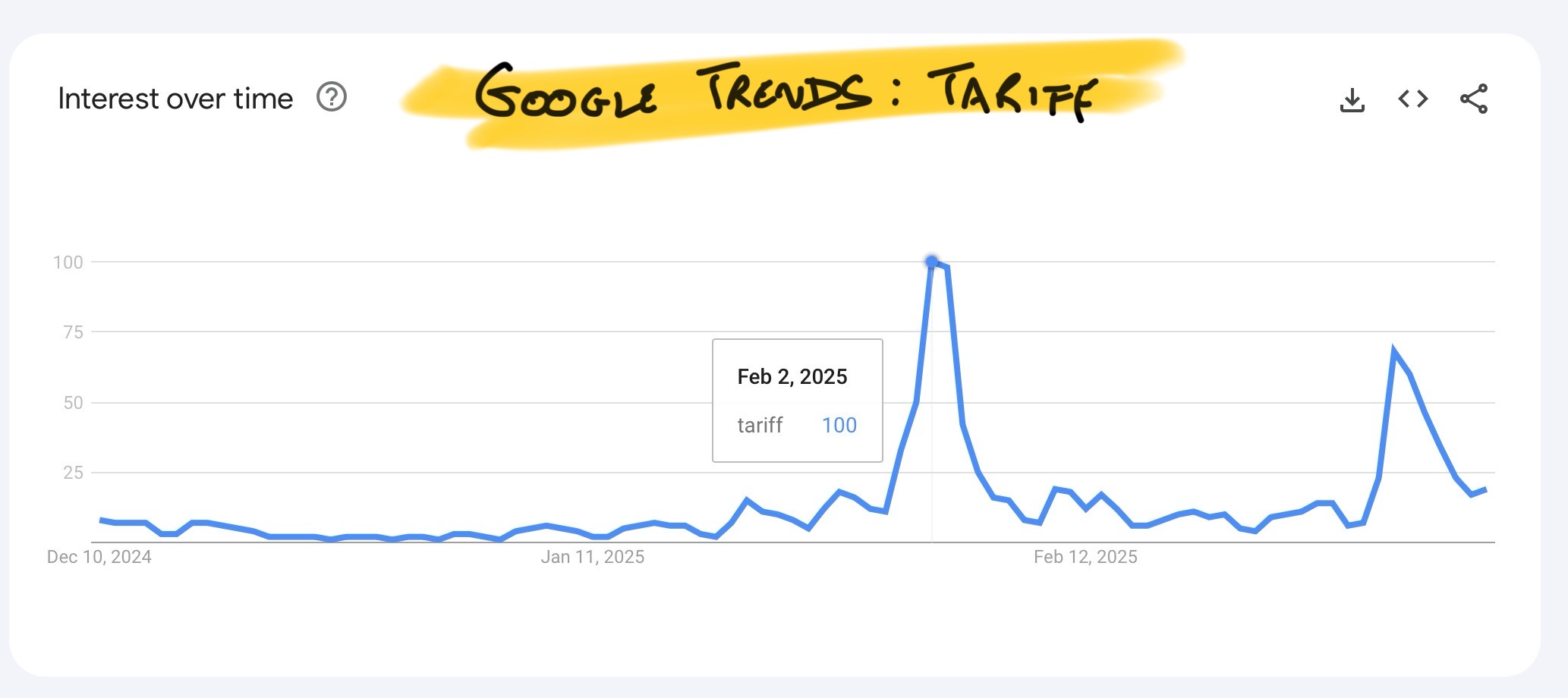

On February 1st the White House doubled down on Tariffs for assorted reasons. On February 2nd searches for Tariffs spiked 5 fold. Consumer Discretionary Stocks are down 11% since.

I do not regard any of this as a coincidence. I don't trade politics but I don't ignore relationships between catalysts and price moves. The best catalysts, long and short, are Large But Unquantifiable With Ambiguous Timing. Gap is getting better and the turnaround is just getting going. They don't need a specific outlook. "Better" works. Tariffs are the opposite. Retailers can get hit by costs, less spending or shrinking margins in general. Some will control the risk better than others but tariffs are bad for all merchants.

If you survived trading 2018 I probably don't have to remind you of this but it's worth pointing out to the newbies.

- The Upside is Limited

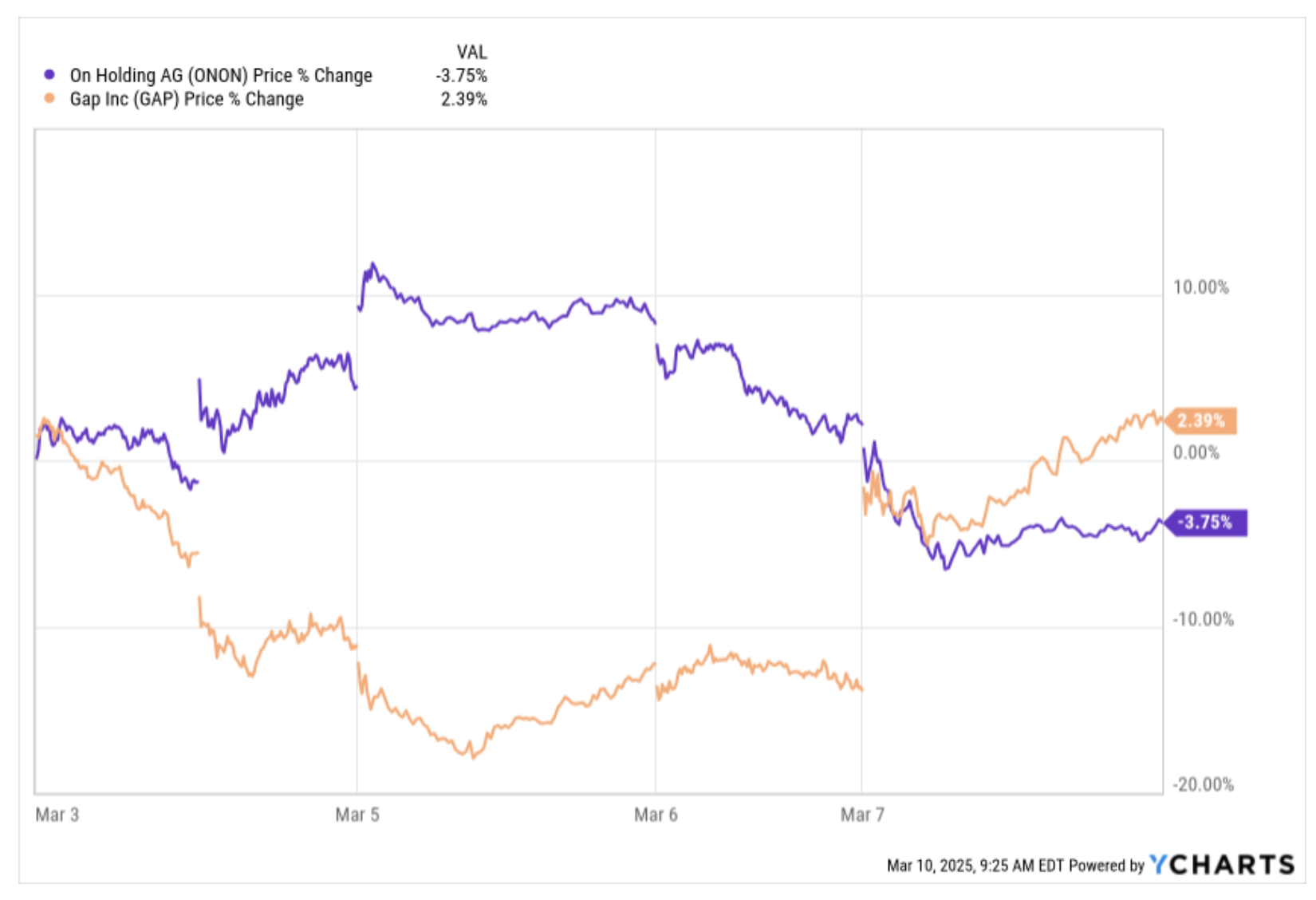

We had a couple upside winners last week in the Gap and On, two names I discussed being long in this space. Both reported just about as good a set of quarters as the Street could have expected. On is crushing, Gap reported basically the same quarter as Abercrombie but didn't whine about a slowdown and had lower expectations.

Picking anything to go higher was frankly a hell of a call last week. As a reward for this excellence it was about a breakeven week, and even then only because we got long the Gap after it fell 10% when ANF got crushed.

PIcking up nickels in front of a steamroller is exhilarating but you gotta be quick. The trend really isn't our friend here.

On and Gap: This is what winning looks like at the moment

The Week Ahead:

No rest for those of us abnormally impacted by Daylight Savings Time. This week has reports from Kohl's, Dicks Sporting Goods, Stitch Fix, American Eagle Outfitters, Ulta and Build a Bear Workshop. Are those household names? Depends on where you live but not generally. When I tell people I'm long Build-a-Bear the general response is along the lines of "those guys still exist?"

BBW is up >1,000% in 5 years and trades at a PE of 10x. So... yeah, they still exist.

But we'll talk about BBW and the rest later this week. For purposes of concision and a sort of retail Darwinian contrast artistic purposes let's talk about the two majors reporting Tuesday morning.

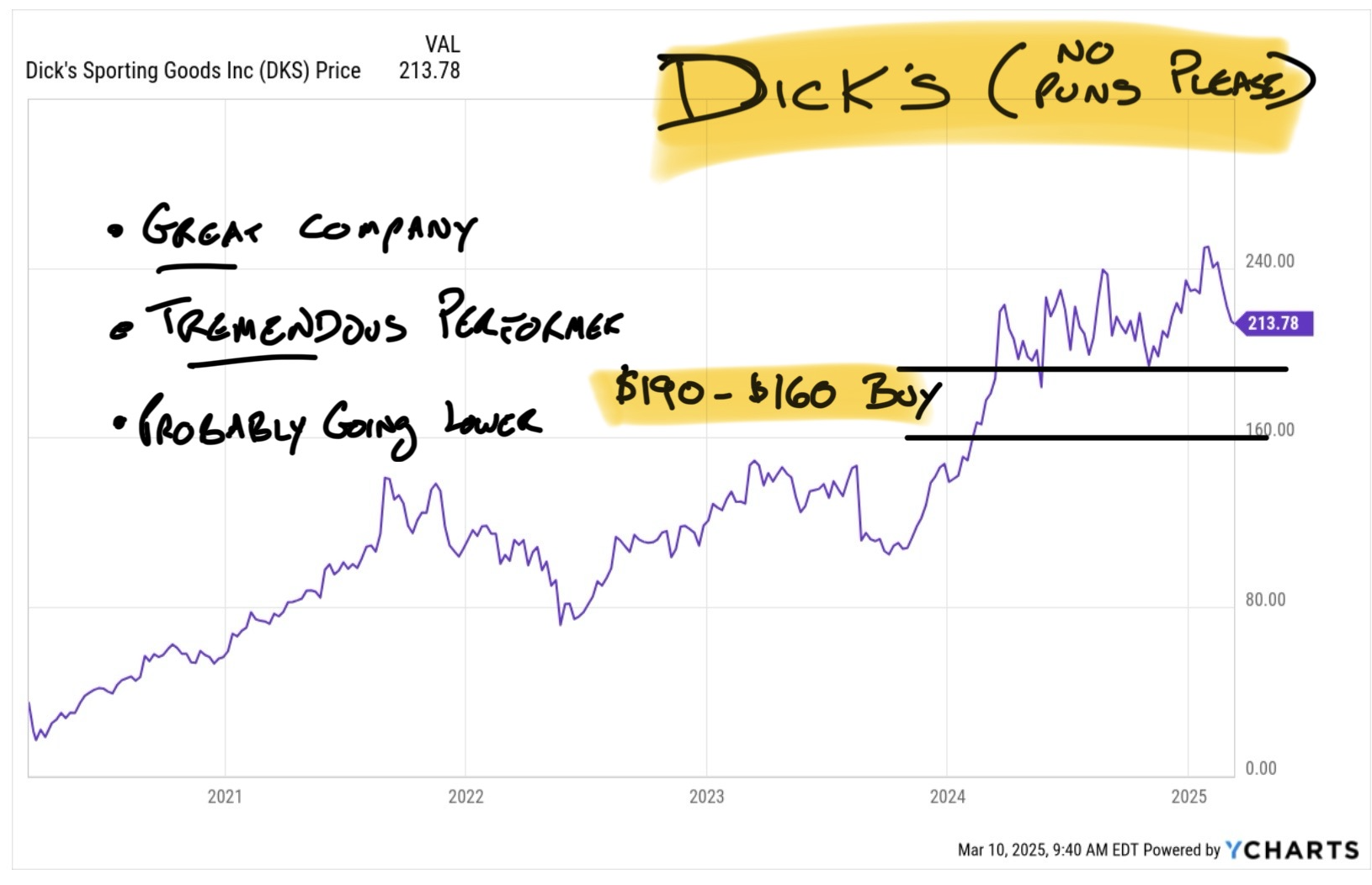

Dick's Sporting Goods is one of the best under-told stories in retail. Pre-COVID Dick's writing down its golf assets and playing Hamlet about whether or not they should sell hunting rifles. Since then earnings, revenue, internet sales and margins have exploded. The company has been totally reinvented.

And I pretty much expect shares to move at least a little lower tomorrow. Possibly a lot lower. I'm not shorting it but I am looking to get long if/ when there's a pullback to support a little below $200.

Kohl's is Macy's without real estate. I don't mean that in a good way. In 2022 Kohl's rejected 3 different suitors, all of whom were bidding (or considering bids) of $55 or more for the chain.

The Kohl's BOD found the offers insufficient. It hasn't turned out well:

I wouldn't buy the Kohl's dip. It's a lousy buyout candidate searching for a reason to exist. Strictly as a trade it probably has a better shot of going higher tomorrow than Dick's does.

That's just the kind of tape we're in for the moment. There are going to be good trades this week but not tomorrow morning. Might be a good time to catch up on some sleep.